The IMF cut its forecast for the global economy and predicted that in 2019, the economy will grow at its weakest clip in three years, thanks to the trade tensions and uncertainty in financial markets, slowing demand across the Europe. It’s the IMF’s second downgrade in just three months, and now, IMF predicts 3.5% global growth for this year, beneath the 3.7% expected in October last year.

Christine Lagarde, IMF’s Managing Director, quoted, “The world economy is growing more slowly than expected, and risks are rising.” Even with unchanged U.S. and China projections, the risks tilt to the downside after China’s revelation of its slowest expansion.

The accelerating risks mainly comprise of Brexit, U.S. – China trade war and China’s slowing economy along with more trade tariffs and a renewed tightening of financial conditions. The market values have changed dramatically over the last few months, thereby ripple effects of these issues has been noticed on the global economy recently.

Similarly, the uncertain resolution of aforementioned risks pose a great danger as it is not sure whether U.K.’s withdrawal from EU will be resolved by March 11 deadline or whether it will be a no-deal exit. Moreover, the U.S. – China trade dispute over the issues of intellectual property, state-owned entities, subsidies and the balance of trade are yet to be resolved.

Trade negotiations between U.S. and China have been ongoing for months now, ever since both countries started slapping billions of dollars of tariffs on variety of goods. They have set a March 2 deadline in their cease-fire for imposition of a new round of tariffs. In addition, the trade war has an impact on how these large economies are growing. China, on 21stJanuary, announced that its official economic growth came in at 6.6% in 2018 — the slowest pace since 1990. Fourth-quarter GDP growth was 6.4%, a sign which shows that the economy is decelerating.

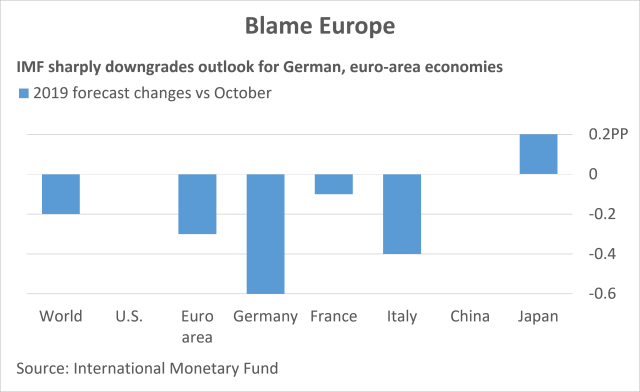

The IMF trimmed the outlook for the 19 countries that use Euro as their currency from 1.8% to 1.6%. Among major economies, the deepest revision was for Germany, which IMF now sees expanding 1.3% this year, revised from 1.9% from October last year. The decline comes from soft consumer demand and weak factory production after the introduction of stricter emission standards for cars.

Weak demand and higher sovereign borrowing costs have led to cutting forecasts for Italy. France’s economy was also hurt by the so-called “Yellow-Vest protests”. The overall Euro area is expected to grow 1.6% this year, 0.3% below the earlier forecast.

Therefore, at this state of uncertainty to mitigate the risks, the policymakers are advised to focus on the issues and how to resolve them. It is suggested for them to be ready with precautionary measures in case a serious slowdown were to materialize. A wise step for all country policymakers would be to harness the existing growth momentum in order to create more policy room to act.

Vanshita Agrawal, Research Analyst at A2Z Insights